unemployment tax credit refund status

Scenarios like this are where GAR Disability Advocates can help workers receive the benefits they are entitled to. Thank you for your Patronage and to be part of the Am Pro Service Inc Family of clients.

Confused About Unemployment Tax Refund Question In Comments R Irs

TurboTax cannot track or predict when it will be sent.

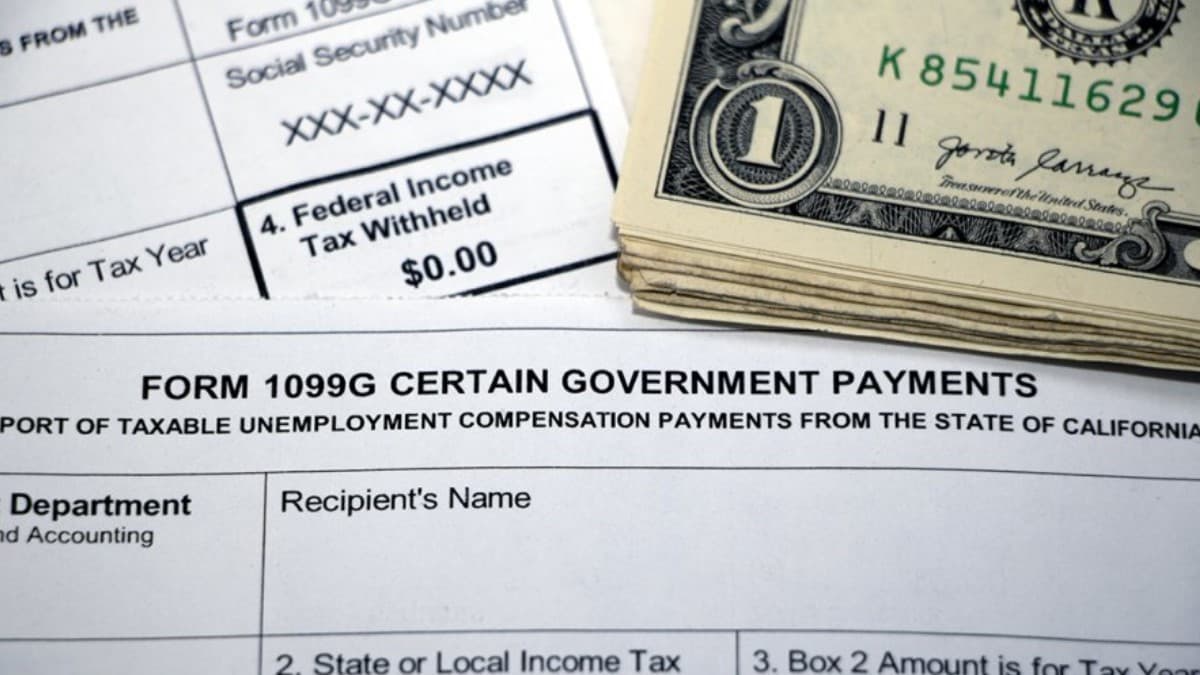

. If you received unemployment benefits in 2020 a tax refund may be on its way to you. If you are eligible for the extra refund for federal tax that was withheld from your unemployment the IRS will be sending you an additional refund sometime during the next several months. State unemployment divisions issue an IRS Form 1099-G to each individual who receives unemployment benefits during the year.

The agency is also making corrections for the earned income tax credit premium tax credit and recovery rebate credit affected by the exclusion. Select the name of the vendor who submitted the refund check. These are called Federal Insurance Contributions Act FICA taxes.

Check For The Latest Updates And Resources Throughout The Tax Season. The 10200 is the amount of income exclusion for single filers not the amount of the refund. Ad Learn About The Common Reasons For A Tax Refund Delay And What To Do Next.

Read on and watch this brief video to learn more about how these two types of benefits affect each other. This is the latest round of refunds related to the added tax exemption for the first 10200 of. As an employer the City also pays a tax equal to the amount withheld from an employees earnings.

With the fourth batch of payments now going out the IRS has now issued more than 87 million unemployment compensation refunds totaling over 10 billion. Use the NJ Refund Status link to go to the New Jersey State Income Tax Refund Status Online Tool just have your 2015 Tax folder ready so you can find the required information. View Refund Demand Status.

The State of NJ site may contain optional links information services andor content from other websites operated by third parties that are provided as a convenience such as Google Translate. Go to the Employees menu and select Payroll Taxes and Liabilities and click Deposit Refund Liabilities. Reason For Refund Failure if any Mode of Payment is displayed.

The IRS began to send out the additional refund checks for tax withheld from unemployment in May. Ad Premium federal filing is 100 free with no upgrades for unemployment tax filing. The IRS is recalculating refunds for people whose AGI is 150K or below and who filed before the tax law that changed the amount of unemployment that is taxable on a federal return became effective.

Senior Freeze Program Property Tax Reimbursement Homestead Benefit Program. Since may the irs has issued more than 87 million unemployment compensation tax. This is not the amount of the refund taxpayers will receive.

This story gets regular updates. The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189 to filers who paid too much in taxes for their 2020 unemployment benefits. One thing to keep in mind however is that SSDI and unemployment have a complicated relationship with each other.

Login to e-Filing website with User ID Password Date of Birth Date of Incorporation and Captcha. Unemployment tax refund status. You can also request a copy of your transcript by mail or through the IRS automated phone service by calling 1-800-908-9946.

In the For Period Beginning field enter the first day of the pay period that the refund affects. Federal law requires employers to withhold taxes from an employees earnings to fund the Social Security and Medicare programs. Fastest tax refund with e-file and direct deposit tax refund time frames will vary.

Property Tax Relief Programs. My unemployment actually went to my turbo card. Property Tax Relief Programs.

Below details would be displayed. If those tools dont provide information on the status of your unemployment tax refund another way to see if the IRS processed your refund is by viewing your tax records online. In the Refund Date field enter the deposit date.

Taxpayers should not have been taxed on up to 10200 of the unemployment compensation. Check the status of your refund through an online tax account. Go to My Account and click on RefundDemand Status.

Whats the latest status on IRS unemployment refunds. And heres how the advance child tax credit payments could affect your taxes in 2022. Feb 17 2022 The IRS considers unemployment compensation to be taxable incomewhich you must report on your federal tax return.

Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly. The IRS has not provided a way for you to track it so all you can do is wait for the refund to arrive.

Unemployment Tax Refund Still Missing You Can Do A Status Check The National Interest

Transcript Help Am I Getting The Unemployment Refund What Does 291 Mean R Irs

Unemployment Tax Refund Question R Irs

![]()

What To Know About Unemployment Refund Irs Payment Schedule More

Irs Sending Out More 10 200 Unemployment Tax Refund Checks Here S How To Track Your Payment

Still Waiting On Your 10 200 Unemployment Tax Break Refund How To Check The Status The Us Sun

Unemployment Tax Refunds Irs To Send More Payments Before End Of Year Gobankingrates

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

How To Claim An Unemployment Tax Refund And How To Check The Irs Payment Status As Usa

What To Keep In Mind About Your Unemployment Tax Refunds Wztv

Irs Unemployment Tax Refunds 4 Million More Going Out This Week King5 Com

Unemployment Tax Break Refund How To Check Your Irs Transcript For Clues

Tax Tip More Unemployment Compensation Exclusion Adjustments And Refunds Tas

Michigan S Delayed 1099 G Unemployment Tax Forms Now Available Online Mlive Com

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor